Financial investment companies are needed to divulge the particular and basic risks of their financial items plus other investment particular info along with a clear declaration of the business’s monetary condition. The Securities Exchange Commission thinks that reasonable and fair markets can just exist when there is full and reasonable disclosure to financiers. https://www.youtube.com/embed/WhJVIagxxwk

The SEC has the authority to perform evaluations and audits of all securities-related organizations, such as broker-dealers and workers and rankings agencies in order to validate misbehavior or insolvency. The SEC has the power to interpret existing securities laws and develop additional legislation as required in order to safeguard investors and control capital markets.

Securities And Exchange Commission: Roles And

It likewise collaborates general securities policy at all levels of government and with foreign federal governments through its membership with the International Company of Securities Commissions (IOSCO). investors claim tysdal. The SEC has the ability to assist police securities scams through the Multilateral Memorandum of Comprehending that it has with other members as well as through direct bilateral regulatory treaties with other governments.

Serious infractions can also lead to significant prison terms (see examples below). The SEC has been a developing force for numerous years now and was inspired by among history’s more notorious events: The SEC was borne from the aftermath of the 1929 stock market crash. In an effort to avoid such occurrences from taking place again, President Roosevelt commissioned a group of experts to evaluate the underlying economic factors that caused the crash (tree lone tree).

Securities And Exchange Commission (Sec) – Allgov

In truth, the only laws then governing the securities industry were understood as Blue Sky laws, which required the registration of financial investment companies and personnel in each state. However, these laws were mainly inadequate due to the ease with which deceitful investment firms might get around them. Roosevelt’s team of specialists discovered that abusive and uncontrolled margin loaning was mostly accountable for the crash as such practices had actually become commonplace in the years preceding it.

The Securities Act of 1933 was the first piece of legislation enacted, which supplied regulations for all going publics and primary issues of securities. Rapidly on its heels, the Securities Exchange Act of 1934 was enacted to control the secondary securities markets and thereby create the SEC. The SEC was charged with the enforcement of all securities legislation and President Roosevelt designated Joseph P.

What Is The Sec? How Does It Affect My Investments?

In addition to headquarter offices, it maintains 11 satellite offices located throughout the country and is governed by a board of commissioners. The Securities and Exchange Commission is headed by a board of five commissioners who are designated by the President for regards to 5 years that operate on a staggered basis.

The 5 divisions of the SEC are Business Financing, Enforcement, Financial Investment Management, Danger, Method and Innovation, and Trading Markets. This branch of the SEC is charged mostly with supervising the financial disclosures of corporations that release any kind of publicly traded security. It periodically reviews the needed filings of these companies, such as K-10 kinds, registration statements for brand-new issues, proxy ballot materials, and annual investor reports plus all documents related to tender offers, mergers, and acquisitions.

The Securities & Exchange Commission: Authority

This branch supervises of preserving fair and equitable trading in the securities markets. It supervises the daily operations of the exchanges, plus self-regulatory organizations (SROs), such as FINRA and the MSRB (Community Securities Rulemaking Board), in addition to transfer agents, clearing custodians, informative administrators, ratings companies, and all of their respective personnel.

It ensures financier deposits for approximately $250,000 per account versus broker-dealer insolvency not market loss. It also helps the Board of Commissioners in the rulemaking and interpretive procedure for all guidelines relating to secondary market trading. This division is committed to overseeing all parties in the securities market that manage assets for investors, including mutual funds, Registered Investment Advisers, portfolio managers, and experts who provide research and commentary on any kind of security.

Sec — Securities And Exchange Commission

When an offense of SEC policies has actually been devoted, the Division of Enforcement actions in. This department makes recommendations to the agency relating to courses of action, such as starting investigations, bringing civil actions, and prosecution. It likewise operates in conjunction with other law enforcement companies and governmental companies, such as the Internal Revenue Service, when needed. attorney alan rosca.

The Department of Enforcement will initially collect proof and other information from historic research, SROs, and other relevant entities. It then has the authority to distribute subpoenas and indictments to witnesses and suspects. Some cases are also referred to federal courts, relying on the concerns included, while others are managed internally as administrative actions.

What Is Securities And Exchange Commission

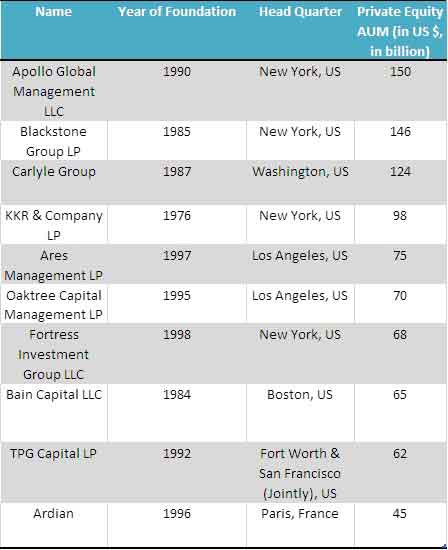

Tyler Tysdal is an entrepreneur and fund manager formerly of Cobalt Sports Capital.

The fast modifications and innovations in the securities markets coupled with the surge of brand-new monetary product or services have impacted our economy and society in methods that we do not yet comprehend. This division of the SEC was for that reason developed to study and keep an eye on the impact of these changes in the economy and on investors in particular.

It may also coordinate with other branches to efficiently monitor particular conditions and aspects that have actually occurred as an outcome of new innovation and other forces. Each division of the SEC also recommends the entities they govern on legal and procedural issues in an effort to educate them on how to finest adhere to policies.

Securities And Exchange Commission (Sec) – Encyclopedia

Whenever the SEC plans to create a new rule, it will first submit a proposition for popular opinion. This proposal will outline the nature and function of the rule along with its execution. The proposition will typically be open to public comment for 30 to 60 days. After this point, the SEC seriously thinks about the input and tries to incorporate it into the particular tenets of the final rule.

These offices consist of the Workplace of the General Counsel, which acts as the primary legal counsel to the SEC, the Workplace of the Chief Accountant, which functions as the consultant to the SEC Chairman, and the Office of Compliance Inspections and Examinations, which analyzes all securities-related examination and inspection programs administered by SROs. manager partner indicted.

Securities Exchange Act Of 1934

The COO, the inspector general, and the secretary have their own workplaces within the company also. tyler tysdal lone. The Workplace of Administrative Law Judges commands the criminal and administrative legal procedures imposed versus prospective securities regulation wrongdoers. The law judges that staff this office consist of independent judicial administrators. Several major pieces of legislation have been passed given that the act that created the SEC.

The contract between the issuer and the trustee need to follow the requirements that are stated in this act. This act controls the activities of the 3 types of investment companies: Face Quantity Certificate Business, handled financial investment business (shared funds), and System Financial Investment Trusts (UITs). Chief among its arrangements is the requirement of educational disclosures by investment firm, such as what securities they hold and their investment policies.

What Is The Sec? How Does It Affect My Investments?

The Act does not mark specific credentials or accreditations that advisors need to have in order to function as such. Nevertheless, the following individuals are ruled out advisors and are for that reason not needed to sign up: Banks that are not likewise investment companies Broker/dealers or their registered agents who get no special compensation for offering advice Publishers of monetary media that has a general and regular circulation Those who deal in U.S.