While this is especially real for the very first audit, ongoing audit requirements are not unimportant. For a small business with lax financial controls, the requirements pointed out above can be daunting. An unskilled CFO might do everything they can to comply with the requirements, however it may not suffice – partner grant carter. Private equity companies won’t be reluctant to bring in more knowledgeable financial professionals who can not only abide by these reporting requirements however assist make sure that the portfolio company provides the expected internal rate of return.

Not only that, however the specific should have the ability to execute the business’s growth strategy, consisting of mergers and acquisitions, and fit well within the culture of the business. As you can think, it requires a skilled person to bridge the gap between a CEO/founder and the needs of their new private equity partner – civil penalty $.

It is easy for feelings to take control of as company executives consider how that capital will take their businesses to the next level. That said, taking outside capital specifically capital from private equity firms isn’t easy. There are certain reporting and compliance requirements that key executives may not prepare for – harvard business school. Eventually, when taking private equity capital, “What got you here won’t get you there,” as executive coach Marshall Goldsmith would say.

And if the existing management can not do so, private equity companies will find somebody who can. Founders and executives need to face this reality prior to taking on private equity financing (titlecard capital fund). Setting proper expectations can prevent some nasty surprises in the future.

So, you wish to work in private equity. You have actually worked difficult to land an interview with your perfect private equity firm. Soon enough, you’ll be able to fly to your private island on your own private jet. Simply one problem. You’re having a hard time to come up with an engaging interview answer to “why private equity?” Concern not.

However prior to you can answer this question correctly, you need to initially comprehend the idea behind this question. So let’s review the value of “why private equity” and why recruiters wish to ask it (cobalt sports capital). Here’s the brief response: If you can’t get this question right, you won’t get the task.

How Does Private Equity Work?

However once your response passes the minimum limit, there’s no need to overdo it since Some candidates, specifically those from the traditional investment banking and consulting background, spend way too much time on this concern. Time that could’ve been far better invested preparing for deal conversations. After all, their compelling story for “why financial investment banking” got them the IBD deal in the very first place.

In fact, we have actually seen IBD uses provided due to the fact that some prospect has a very engaging “why financial investment banking” response. That’s not truly the case with private equity interviews. You will never get an offer solely because you have a killer factor for why you want the task. How can we be so sure?Simply since that’s not how the private equity people run. securities fraud theft.

Not charity. Nobody is going to employ you simply due to the fact that you have the world’s most compelling or special factor to do the job. They’ll just employ you if they think employing you will Simply put, they’ll hire you if they believe you’ll assist them generate income. Do you have a great financier mindset that can assist them identify lucrative opportunities? Are you well polished enough to coordinate amongst banks, attorneys and accountants? Are you a good modeler who can help them produce error-free financial designs to facilitate their analysis?You will not get the offer since you worked difficult to get to where you are.

See the difference?These are simply some examples of a Partner’s value-add. PE companies wish to employ people who will include the most worth to their group. Private equity interviewers are not asking this concern so they can hire whoever has the very best factor. Rather the opposite. This is a simple way to recognize the prospects they do not desire.

They believe it’s going to be something and it ends up being another. Next thing you understand, they understand they don’t wish to do the job anymore. This negatively affects the private equity firm’s performance and spirits, which is bad for service. Consider Mike (invested $ million). Mike is an overworked lender desiring to operate in PE so he does not need to make profiles or decks any longer.

One month in, profiles and prolonged presentations on CIMs is all that Mike has actually done. What do you believe takes place to Mike’s motivation? He slowly become annoyed with the work and stops taking initiatives. Productivity decreases all because the job interviewer didn’t find that the job isn’t what he wanted. state prosecutors mislead.

Private Equity: Definition, Firms, Funds, Effect

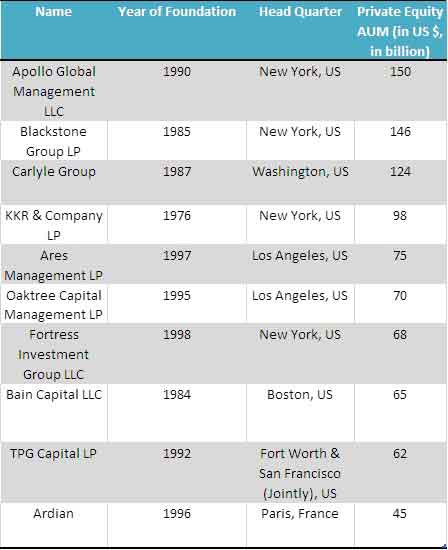

Specific funds can have their own timelines, financial investment goals, and management approaches that separate them from other funds held within the same, overarching management firm. Effective private equity firms will raise many funds over their life time, and as firms grow in size and intricacy, their funds can grow in frequency, scale and even specificity. To find out more about business partner and also - check out his websites and -.

Prior to establishing Freedom Factory, Tyler Tysdal managed a development equity fund in association with numerous stars in sports and entertainment. Portfolio business Leesa.com grew rapidly to over $100 million in profits and has a visionary social mission to “end bedlessness” by contributing one bed mattress for every single ten offered, with over 35,000 donations now made. Some other portfolio companies were in the industries of white wine importing, specialized lending and software-as-services digital signage. In parallel to handling possessions for businesses, Tyler was managing personal equity in real estate. He has had a number of effective personal equity investments and a number of exits in trainee real estate, multi-unit real estate, and hotels in Manhattan and Seattle.

Associates giving up mid-way through their PE program is very disruptive to the teams. This takes place quite frequently. Or Sarah. Sarah is a management expert who can’t wait to operate in PE so she doesn’t need to take a trip any longer. 2 months in, her private equity firm sends her to camp out of Rancho Cucamonga for a month to help a portfolio company’s FP&A group with its accounts payable and receivable ability.

To avoid these scenarios, private equity interviewers ask you “why private equity” to make sure you desire to do it for the ideal factor. This one is simple. Some prospects like to go into an entire story about their finance spark and journey that led them to private equity. They must do that just in the beginning of the interviews where the interviewers ask to walk through their resume.

3-5 sentences does the job. It examines the box. It addresses the concern and the interviewer wishes to carry on. Choosing an extended response here is not a smart relocation. You run the risk of losing the interviewer’s interest by being verbose. Worse, there’s no upside rewards that included this danger.

So you only have downside danger, but no upside reward. If the recruiter wishes to penetrate even more on this subject, he’ll ask follow up questions. When he does, do not hesitate to go into your story-telling mode. You can offer him that story about how you operated a small company when you were 8 years old and how it influenced you to be the new.Some reasons that you can use to address “why private equity” are noted below.

You take pleasure in learning more about services and what makes them terrific. You wish to establish portfolio operations skill set in addition to financial analysis, which sets you up well for a career in investing. You prefer to be more associated with the due diligence process beyond simply monetary modeling because you’ll find out all elements of the company.

PE has shown to be the financial investment style that delivers the most consistent returns over the long-run. I want to work in private equity because I truly like the opportunity to learn all aspects of the business beyond simply the P&L. And coming from an investment banking background, I believe the capability to work closely with portfolio business will boost my understanding of companies, which will set me up effectively for a profession in investing.